In the financial markets, traders utilized the terms tick, point, and pip to expose value changes. Although traders and market analysts utilize all of the three terms in a related way, each is unique in the level of progress it implies and way to utilize it in the markets. The lowest feasible value change on the right side of a decimal point represents a tick. Whereas the lowest feasible values change on the left half of a decimal point represents a point. A pip, “point in percentage,” is also the lowest change to the right side of the decimal point as like tick. Yet it is a vital assessment tool in the forex market.

Pip

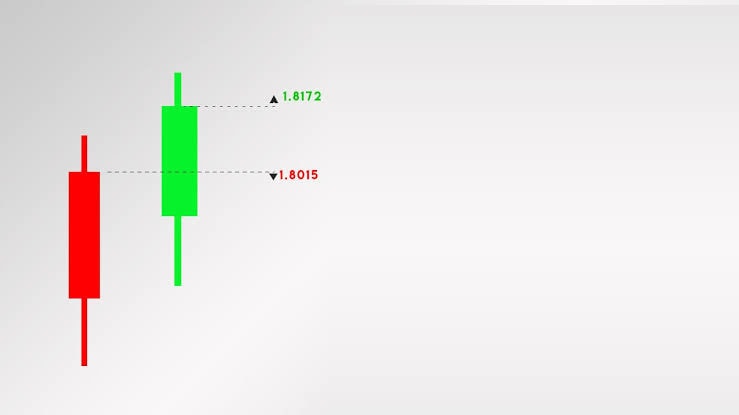

A pip is an abbreviation for “percentage in point” or “price interest point”. In an exchange rate of a currency pair, a pip represents a change of a unit. The exchange rate can execute depend on market tradition. Currency pairs are normally estimated to four decimal places. Also, the lowest change is the least decimal point. This would form one pip equal to 1/100 of 1 percent either one basis point. Like, the lowest move the USD/CAD currency pair can execute is $0.0001 either one basis point.

Point

A point represents the larger value change of the three estimates. And also introduces changes on the left half of the decimal. Whilst pip and tick introduce fractional changes for the right. In the traders’ selected markets point is the most used term to represent value changes.

An investor with shares in Company XYZ stock may expose a cost increment from $135 to $140 as a five-point movement as opposed to a $5 movement.

Several indexes repeat costs in a way that enables investors to mark value changes in points. For instance, the investment-grade index tracks value movements to the fourth decimal. In any case, when providing cost estimates, it moves the decimal four points to the left so developments can be expressed in points. So, the cost of 1.23457 is expressed as 12,345.7.

Tick

A tick indicates a market’s lowest feasible value movement to the right side of the decimal. As an example, IG Index indicated unable to move the decimal places to utilize points, its value movements aspiring followed in additions of 0.0001. A value change, at that point, from 1.3345 to 1.3346 would denote one tick. Ticks don’t need to be estimated in variables of 10. For instance, a market may quantify value movements in the least additions of 0.25. Since in that market, a value change from 550.00 to 551.00 is four ticks either one point.

The lowest tick size was 1/16th of a dollar, in earlier April 2001. That intends the stock might just move in increases of $0.0625. While the presentation of decimalization has profited investors through much smaller bid-ask spreads and better value finding, as well as it has made market-production a less beneficial activity.

Key Issues

– Pip, tick, and point are standings used to show value changes in the financial markets.

-When traders and analysts utilize every three terms in the same aspect, each one is unique in the level of change it indicates and how it is utilized in the markets.

-A few indexes repeat costs in a way that enables investors to follow value changes in points.

Key Concepts of Forex Market

In contrast to the stock market, where investors have a huge number of stocks to pick from, in the currency market you just need to pursue eight significant economies and afterward figure out which will give the best undervalued or overvalued chances. The following eight nations make up most of the trade in the currency market:

-Japan

-United Kingdom

-United States

-New Zealand

-Eurozone (the ones to watch out for Germany, Italy, Spain and France,)

-Switzerland

-Australia

-Canada

In the whole world, these economies have the biggest and most modern financial markets. We can get the benefit of earning interest revenue on the utmost creditworthy and liquid instruments in the financial markets, by carefully concentrating on these eight nations.

Financial information is discharged from these nations on a practice routine, enabling investors to remain over the game with regards to surveying the strength of every nation and its economy.

Know the Interest Rates

It is important to know where interest rates are going in forex trading. It also requires a decent comprehension of the fundamental economics of the nation being referred to. As a rule, nations that are performing well indeed, with solid growth rates and expanding inflation will most likely raise interest rates to tame swelling and control growth. On the other side, nations that are confronting troublesome economic conditions running from a wide slowdown in demand to a full downturn will reflect about decreasing interest costs.

How much worth of pips and how they act in currency pairs?

Inside forex markets, currency exchange is controlled repeatedly by the U.S. dollar, the euro, the Japanese yen, the Canadian dollar, and the British pound.

As we know, Pip is a form of calculation associated with any minimum price movement done through any exchange rate. Currencies are normally quoted to four decimal points. That means the lowest change in the currency pair will be in the last digit.

Currency pair is the quote of two distinct currencies, by the worth of one currency being quoted across the other. The EUR/USD currency pair is viewed as the most liquid currency pair. Here the first one is the base currency and the other one is the quote currency. As an example, to purchase EUR/USD at 1.1300 on an exchange for 100,000 currency units, you would need to pay US$113,000 (100,000 * 1.13) for 100,000 euros.

The Relation to Pips and Profitability

The profit or loss of a trader always depends upon the movement of the currency pair. If a trader purchases the EUR/USD will be benefited in case of the Euro increments in value compared with the US Dollar.

Wherever the trader purchased the Euro for 1.1735 and withdrawn the trade at 1.1801, the person would make 1.1801 – 1.1735 = 66 pips on the exchange.

If a trader purchases the Japanese Yen in selling USD/JPY at 112.07. On this exchange, the trader loses 2 pips when closed at 112.09 yet benefits would be 6 pips when closed at 112.01.

Inside the multi-trillion dollar foreign exchange market the difference looks small, gains and losses can add rapidly. Like, if a $10 million range is closed at 112.01, the trader will reserve a $10 million x (112.07 – 112.01) = ¥600,000 benefit. This benefit in US dollars is determined as ¥600,000/112.01 = $ 5,356.66.

The Bottom Line

Because of the far-reaching accessibility of electronic trading networks, forex trading is currently more available than forever. The biggest financial market in the world proposes massive opportunities for investors who set aside the effort to get the opportunity to get it and figure out how to relieve the risk of trading here.