© Techolac © Copyright 2019 - 2022, All Rights Reserved.

Internet

Best 8 Cheapest Cloud Storage Providers In 2024

Are you searching for the cheapest cloud storage possible? We show you the very best budget plan cloud storage for...

Read moreBusiness

Editor's Pick

MORE NEWS

15 Best Free OCR Software for Windows 10/11 in 2024

OCR software has revolutionized the way businesses handle their digital documents. With its advanced technology and features, OCR software enables...

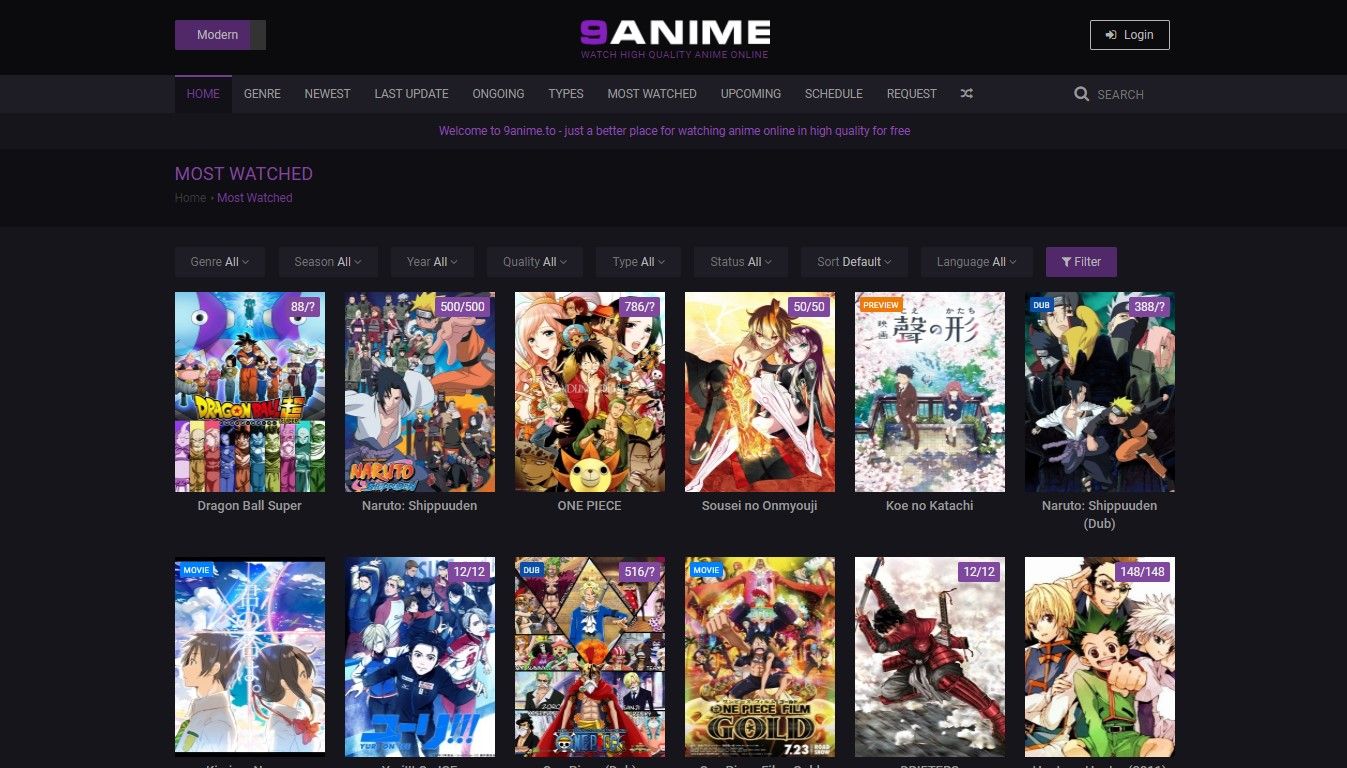

What Happened to Toonily? 24 Best Toonily Alternatives in 2024

Are you a fan of manhwa, the captivating world of Korean webcomics? Look no further than Toonily, an online platform...

Is Cowordle Free? Best 10 Games like Cowordle in 2024

Welcome to the exciting world of Cowordle, the latest craze in the realm of word puzzles. Cowordle has captivated puzzle...

Unlock the Benefits of a Goodyear Credit Card

When it comes to taking care of your vehicle, Goodyear is a trusted name that offers quality tires and exceptional...

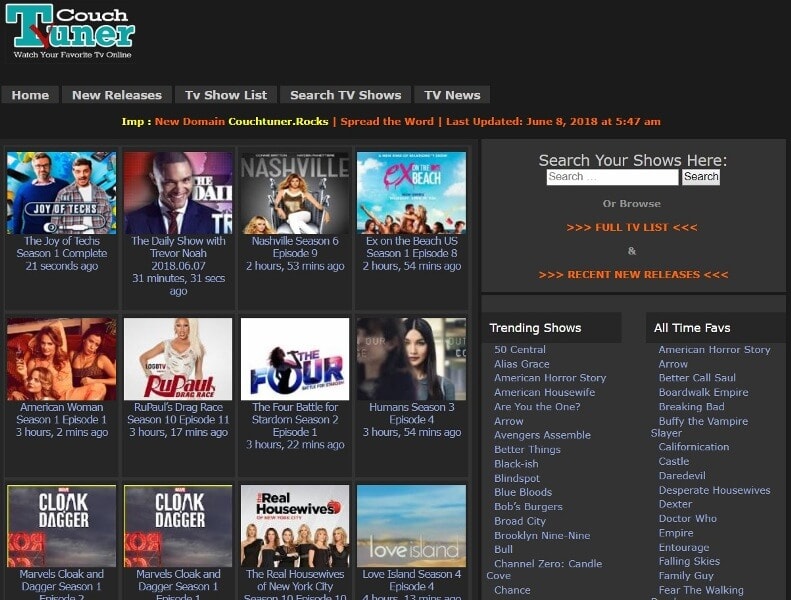

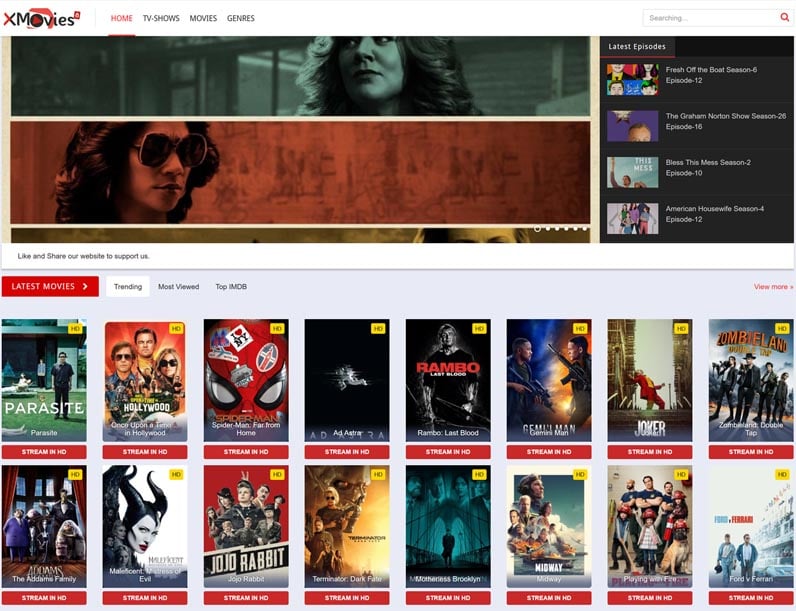

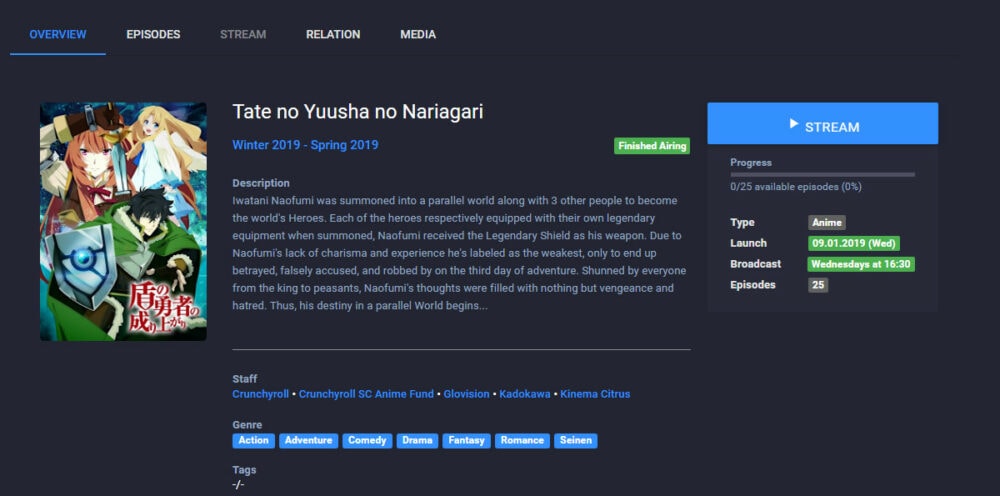

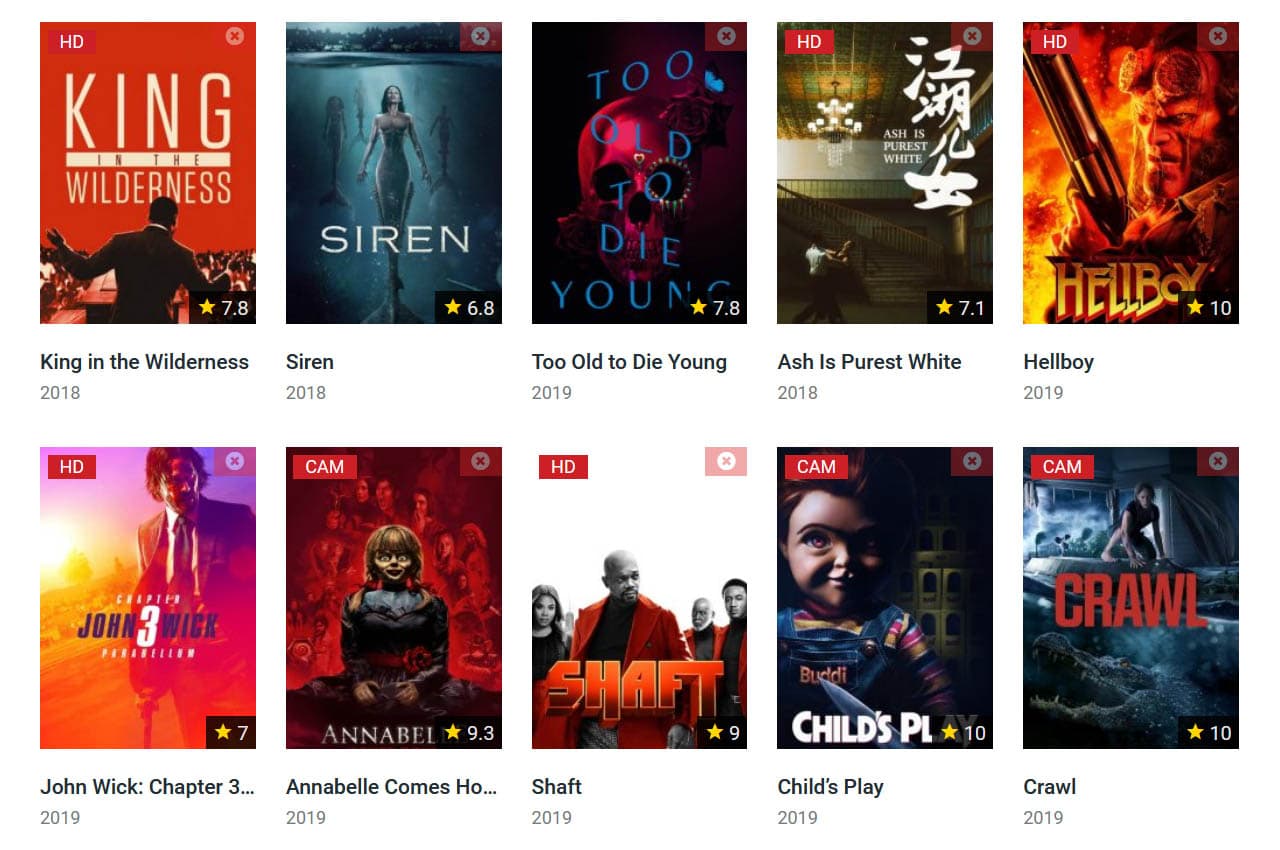

What is Goojara? Best 20 Goojara Alternatives for Watch Movies

Goojara, the ultimate platform for streaming movies and TV shows! In this comprehensive guide, we will provide you with all...

How To Fix When Discord Green Circle But No Sound

This article will show the solution when discord green circle but no sound. Nonetheless, several video game fans articulated that...

Best 5 Drift Live Chat Alternatives to Boost Customer Service

5 Drift Live Chat Alternatives to Boost Consumer Assistance. Customer assistance has been a factor since trade has been around....