You’re likely aware that QuickBooks alternatives is the ruling incumbent for accounting software in the United States. There’s a reason that a lot of small businesses rely on QuickBooks for their business needs– it’s easy to use, low-cost, and training resources for the software abound. However, if you’re searching for QuickBooks alternatives, whatever your reason, fantastic options do exist.

Although there’s plenty working in QuickBooks’s favor– market supremacy, ease of use, and a low price point, for example– there are some QuickBooks alternatives for small companies available you might wish to consider when you’re thinking about your financials. We’ll analyze all of the best QuickBooks alternatives (consisting of some free QuickBooks alternatives) and compare what they need to provide so you can choose if they’re the ideal pick for your small business.

Top QuickBooks Alternatives for Small Businesses

In this article, you can know about Top QuickBooks Alternatives for Small Businesses here are the details below;

The 10 Best QuickBooks Alternatives for Small Businesses

As you’re taking a look at these QuickBooks alternatives, before you settle on an option, ensure your information isn’t “trapped” if you change your mind. You want to have the ability to quickly move data in and out of services, specifically if your requirements alter as your organization grows. This is, of course, why it’s finest to investigate several alternatives before making your final decision!

You can typically (although not constantly) get an Excel or a CSV file of your information should you choose to change software application. Make certain to confirm that before registering. This will save you from having to invest important hours returning to data by hand.

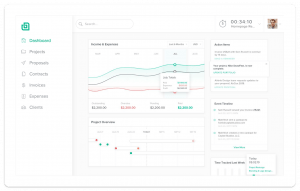

1. Xero: Best Overall QuickBooks Alternative

Xero is likewise a complete accounting bundle. This New Zealand-based company is the market leader in New Zealand, Australia, and several European countries, too. Constructed “in the cloud, for the cloud,” Xero had prevented many of the perceived mistakes its competitors had actually made when they transitioned to cloud-based accounting services, making it a great alternative to QuickBooks.

Xero touts itself as “gorgeous accounting software application,” and, really, it is. 2 of the things small company owners love most about this alternative to QuickBooks Online is the simplicity of its interface and its avoidance of accounting and finance lingo. No debits or credits here– just easy-to-understand language that makes it basic to identify what to do with your transactions. The reconcile-as-you-go function is also a favorite of small business owners. However, lots of accountants and accountants prefer a separate reconciliation function.

Xero has three pricing tiers. If you’re a super-small service, the Starter bundle at $9/month might work for you. However, the majority of small companies rapidly outgrow this bundle and move up to the $30/month Standard bundle. More complicated businesses dealing with numerous currencies and bigger payrolls require the Premium plan, which starts at $70/month.

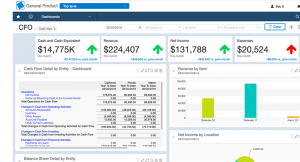

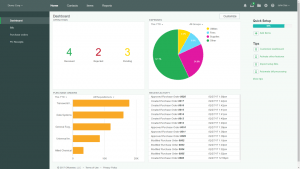

2. Sage: Most Versatile QuickBooks Alternative

Sage is a complete accounting plan. It produces a balance sheet and enables bank reconciliations. Starting at simply $10 each month for Sage Accounting Start, it’s really competitively priced, too.

Have you required more features than those provided in the $10 per month version? You can pick Sage Accounting for $25 each month to unlock unlimited cooperation, quotes and estimates, vendor expense tracking, cash flow forecasts, and the option to choose either cash or accrual basis accounting. There’s also HR tools, POS integrations, eCommerce features, and sales and marketing features.

Like Intuit (the maker of QuickBooks), Sage has a wide variety of options for helping you scale your service, consisting of an accountant partner program and its own series of conferences to assist you in learning, collaborating, and growing.

3. FreshBooks: Best for the Self-Employed

What started as an invoicing- and time-tracking software application has actually evolved into a powerhouse for the self-employed. FreshBooks lets you billing and collect payments from your customers, track your expenses, and collaborate with your subcontractors. It likewise deals with a suite of external applications to assist you in building a genuinely customized option for your organization.

If you’re stressed over getting stuck on a problem with the software application and needing to wade through pages of online FAQs to attempt to resolve the issue yourself, don’t be. FreshBooks has excellent customer-service partners who react quickly to your concerns, frequently responding within an hour.

What FreshBooks does refrain from doing is keep a balance sheet. A design template is offered if you need to produce one, but FreshBooks suggests looking for the help of your accountant if this is essential. This can quickly end up being a pricey endeavor, so if your organization needs a balance sheet, FreshBooks is not the right service for you.

When it comes to price, FreshBooks begins at $15 each month, though the majority of small companies will require the $25/month strategy. There’s likewise a Premium option readily available for $50/month; however, by the time a company reaches this stage, it will likely need a more robust option. Additionally, for a restricted time just, FreshBooks is using 50% off for the very first three months when brand-new users avoid the 30 days complimentary trial period.

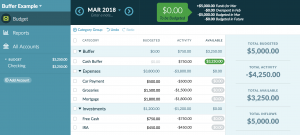

4. YNAB: Best for Running Financial Reports

Though technically not an accounting software application, lots of small businesses utilize YNAB as though it is. After effectively using it in their individual financial resources, it didn’t take savvy YNAB users long to identify how to take advantage of the software’s zones of genius– expense tracking, setting goal, and debt management– in their businesses.

YNAB does not have a balance sheet, it doesn’t handle invoicing or payroll, and there isn’t a bank reconciliation feature. However, it does have bank syncing, gorgeous reporting, and an avid assistance neighborhood to help you form and adhere to your goals. While it’s not quite a totally free QuickBooks option, at $6.99/ month (if paid annually), the rate is certainly budget-friendly.

Are you intrigued by considerably increasing the success of your company by leveraging your existing routines? This podcast episode informs how you can utilize YNAB with the “Profit First” technique to bring clearness and awareness to your finances and proactively increase your success.

5. QuickBooks Self Employed: Best for Sole Proprietors

Yes, we’re supposed to be talking about QuickBooks alternatives. Nevertheless, QuickBooks Self Employed is not your traditional QuickBooks software. It truly is an option to QuickBooks Online– at least the QuickBooks Online you’re thinking of. Created specifically for the Schedule C filer, this variation of QuickBooks has a fantastic mileage tracker, receipt capture, and the capability to classify a cost as either business-related or individual with a quick swipe on your smartphone.

QuickBooks Self Employed does not consist of a balance sheet, nor does it currently allow you to update to a more robust QuickBooks item. It does, however, permit accounting professional collaboration, and at $15/month– even less with the discount rate– it costs much less than the other QuickBooks Online alternatives. For a restricted time, you can get $1 for the first 12 months on QuickBooks Self-Employed.

6. Wave Accounting: Best Freemium Option

Wave Accounting is a completely free accounting software application– nevertheless, you’ll have to pay extra to access its full series of features (later will talk about an accounting option you can really use at no cost whatsoever). With Wave Accounting, you’ll have the ability to rapidly and easily establish your Wave account, connect your company checking account, and start using all of the functions the software needs to use. With your checking account linked, you’re accounting details will appear immediately.

A few of the tools developed into Wave Accounting consist of earnings and expense tracking, personalized invoicing and receipt scanning, visitor collaborators, exportable accounting reports, invoicing, invoice printing, and the capability to connect with PayPal, Shoeboxed, and Etsy. And once again, all of this is totally free.

However, to access the potential of Wave, you’ll require to pay extra. Features like sending out and getting payments and running payroll cost extra. For that reason, we can’t recommend Wave for large groups. However, if you’re trying to find a basic accounting tool at no cost, you can’t get better than Wave.

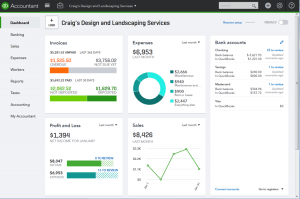

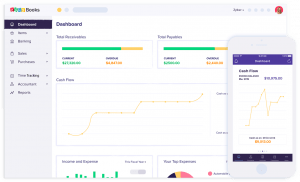

7. Zoho Books: Best for Those Who Use Other Zoho Apps

Zoho Books becomes part of the Zoho suite of services– which includes over 40 various business apps, including CRM, HR tools, and reporting alternatives. As a web-based platform, Zoho Books permits you to access your account anywhere you have internet, in addition, to utilize their mobile accounting app for either iOS or Android.

The cost of Zoho Books is split into three tiers, enabling you to update and accommodate your organization’s growth. The three Zoho Books plan variety in performance, separating largely in the number of contacts, users, and workflows that are included within your account. The Basic plan costs $9 monthly, the Standard plan costs $19 monthly, and the Professional plan costs $29 each month.

Features you’ll get regardless of your plan consist of invoicing, cost estimates, the ability to integrate your bank accounts, project and expense tracking, reporting tools, a client portal, custom-made tax options, in addition to the capability to integrate with any of Zoho’s other software applications, and third-party tools like Zapier and Square POS.

8. Bonsai: Best for Freelancers

Next up on our list of QuickBooks alternatives is Bonsai– a task management software for freelancers that has some awesome accounting features integrated in. With Bonsai, you can track your billable expenditures by developing an expenditure, appoint it to a job, and attaching those costs to a billing. You can likewise connect your savings account to import your expenditures. What’s more, Bonsai generates expenditure reports and analytics so you can understand your spending in time.

What’s more, Bonsai allows you to set up recurring payments, and be paid through charge card, ACH transfer, PayPal, and even bitcoin. Other tools consist of an independent tax calculator, reporting functions, time tracking, and the ability to develop customized customer proposals and contracts.

Bonsai costs $16 per month for their Plus plan and $24 each month for their Premium plan. Both strategies include all the previously mentioned, but the Premium strategy also consists of white labeling, subcontracting, and the alternative to add additional users to your account.

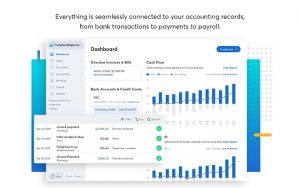

9. FreeAgent: Best Small Business Option

FreeAgent is an accounting software application developed particularly for small business owners. It only has one price–$ 24 monthly–and it includes pretty much everything you’ll require from an accounting viewpoint. This includes invoicing, expense tracking, sales tax calculation, and a dashboard that provides you a real-time view of your capital. Other FreeAgent benefits include automated bank feeds and a mobile app.

10. Spendwise: Best for Inventory Management

Last on our list of QuickBooks alternatives is SpendWise, which is a fantastic alternative for the retail entrepreneur. This is since this accounting software application includes robust inventory tracking functions. With spends, you can produce purchase orders for suppliers and produce sales orders and quotes for clients. When orders are filled, SpendWise will automatically update your inventory quantities and expenses.

In terms of accounting tools, SpendWise permits you to track unpaid bills, sales, and expenditures. There’s likewise reporting tools. Nevertheless, SpendWise does not presently integrate with checking account or charge card. What’s more, you don’t get access to all features unless you spend for the Enterprise strategy (quote-based)– which features stock management and multi-currency payments. Spends Basic ($ 9 each month) is going to restrict the variety of purchase orders you can make each month and spends Pro ($ 19 each month) does not enable you to see upgraded stock when orders are filled.

What are the very best Free QuickBooks Alternatives?

There are free QuickBooks alternatives offered, and many claims to be just as excellent as subscription-based solutions. Although some entrepreneurs utilize these totally free QuickBooks alternatives with excellent outcomes, free accounting solutions are typically doing not have in performance, dependability, user experience, or customer service. You need to consider what this might cost your business. As your accounting software application will be the foundation of your company, paying a little sum for a better system is most likely worth it.

If you pick not to invest in an accounting solution and your business is very small and not complex, your best option is to use Excel design templates to keep track of your service finances. Novice Bookkeeping has a library of complimentary templates readily available, along with explanations of fundamental accounting concepts, so you comprehend how to use the design templates.

If you wish to use this as a totally free QuickBooks alternative, here are a few of our favorites from Beginner Bookkeeping:

- Excel Cash Book

- Accounts Receivable Ledger

- Accounts Payable Ledger

- Capital Template

- Income Statement Template

- Balance Sheet Template

How to Decide Between QuickBooks and QuickBooks Alternatives

Here is a list of concerns you should ask to help you make the ideal choice for your organization:

-

What accounting functions do you need to be able to handle?

Think about the following things you might need to do in your company:

- – Invoice your customers or clients for payment later on

- – Track costs for future payment

- – Then track and manage devices or other service possessions

- – Track income and expenses by task, task, or consumer

- – Collect and remit sales tax

- – Manage payroll for yourself or your team

-

How frequently will you use your software– or reports from your software application– to make service choices?

- – Will you examine your financial reports routinely, or do you simply wish to track earnings and costs for tax purposes?

- – Do you need to be able to link your accounting software application to outdoor applications, like dashboards, to help you picture your company’s efficiency?

-

What do you picture for the future of your servicsmallo you want to keep your service little and privately held, or do you imagine eventually going public?

- – Do you think you will always manage most of your accounting procedures in-house, or is one of your goals to contract out these tasks to an outside company?

- – Are you open to the possibility of seeking small business loans and financing eventually in your organization’s life time, or are you dedicated to running entirely debt-free?

There are no “ideal” or “incorrect” answers here when you’re considering QuickBooks or QuickBooks alternatives. Be honest with yourself and how you want to run your service. This will be the key to choosing the ideal option for your organization.

The Final Word

With these QuickBooks alternatives, you’ve just barely started to scratch the surface of what is offered to small business owners. These alternatives may prove to be a good fit for you, or they may all fall flat. A lot of accounting software application choices offer a complimentary trial period– normally 30 days– so you can try out different options before you devote to one. And, if you’re thinking about a complementary option, the only thing it will cost you is time.

Your monetary information is a fundamental part of your organization, and monetary information management can take hours of your time if you choose the incorrect solution or set it up improperly. Whatever you decide to utilize, seek the assistance of an accountant or an accountant to effectively set up your software. Most of the options noted above have neighborhoods of specialists who are either certified in or extensively utilize the software application. When you have actually decided on your software application, reach out to one of these experts to help you get off on the ideal foot.

Check out over other articles like :